GOLD ALSABAEK

28

فبراير

ارتفع الذهب إلى مستوى 5280 دولار مسجلا أعلى مستوى في شهر ومدد مكاسبه للشهر السابع على التوالي مدعوما بتصاعد التوترات الجيوسياسية وصدور بيانات تضخم أمريكية قوية عززت حالة القلق في الأسواق

قراءة المزيد

GOLD ALSABAEK

23

فبراير

يواصل الذهب اتجاهه الصاعد لليوم الرابع على التوالي، مدعومًا بمزيج من العوامل الأساسية، في مقدمتها تصاعد المخاوف التجارية والتوترات الجيوسياسية، إلى جانب تراجع الدولار الأمريكي وتزايد الرهانات على خفض أسعار الفائدة من قبل الاحتياطي الفيدرالي.سجل المعدن الأصفر أعلى مستوى له خلال شهر جديد في تداولات الإثنين قبل أن يتوقف لالتقاط الأنفاس، إلا أن الخلفية الأساسية الداعمة تعزز احتمالات استمرار الاتجاه الصاعد. فقد أدت تجدد مخاوف الحرب التجارية، إلى جانب تصاعد التوترات في الشرق الأوسط، إلى تعزيز الطلب على الذهب كملاذ آمن.وأعلن الرئيس الأمريكي دونالد ترامب عن إطار جديد للرسوم الجمركية عقب حكم من المحكمة العليا ضد الرسوم الواسعة التي فرضها سابقًا، وقرر فرض رسم عالمي جديد بنسبة 15% على الواردات إلى الولايات المتحدة — وهي النسبة القصوى المسموح بها قانونيًا. وأثار هذا القرار مخاوف من إجراءات انتقامية وتأثيرات اقتصادية سلبية محتملة نتيجة اضطراب سلاسل الإمداد العالمية، ما ضغط على شهية المخاطرة ودعم الإقبال على الذهب كأصل دفاعي.

قراءة المزيد

GOLD ALSABAEK

21

فبراير

أعلن الرئيس الأمريكي دونالد ترامب، يوم السبت، رفع الرسوم الجمركية العالمية المفروضة على عدد من الدول من 10% إلى 15% بأثر فوري.وشهدت الولايات المتحدة اضطراباً اقتصادياً ملحوظاً يوم الجمعة بعد قرار المحكمة العليا بإلغاء الرسوم الجمركية التي كان ترامب قد فرضها على عدة دول في أبريل الماضي. وقد كان للحكم تأثير فوري على الأسواق، بما في ذلك الأسهم والسندات والمعادن، وسط حالة من عدم اليقين بشأن آلية استرداد العائدات التي تم تحصيلها من تلك الرسوم.وفي منشور على منصته “تروث سوشيال”، أوضح ترامب أن قرار رفع الرسوم الجديد جاء رداً على حكم المحكمة العليا المتعلق بقانونية بعض الرسوم السابقة

قراءة المزيد

GOLD ALSABAEK

21

فبراير

قفز الذهب فوق مستوى 5,090 دولارًا للأونصة يوم الجمعة، ليختبر أعلى مستوياته الشهرية، بعد صدور حكم تاريخي من Supreme Court of the United States ضد الرسوم الجمركية العالمية، ما أدى إلى تقلبات حادة وتدافع نحو أصول الملاذ الآمن.ورغم أن المحكمة أبطلت الرسوم المتبادلة، فإن التراجع الأولي في الدولار الأمريكي تبدد سريعًا بعد تعهد الرئيس Donald Trump بتوقيع رسوم جمركية عالمية جديدة بنسبة 10% عبر أمر تنفيذي. هذا التحول الفوري في السياسة التجارية، إلى جانب صدور بيانات ضعيفة للناتج المحلي الإجمالي للربع الرابع عند 1.4%، عزز جاذبية الذهب كأداة تحوط ضد المخاطر وتباطؤ النمو.

قراءة المزيد

GOLD ALSABAEK

21

فبراير

ارتفع مؤشر S&P/TSX Composite بنحو 0.3% ليتجاوز مستوى 33,700 نقطة للمرة الأولى يوم الجمعة، متجهًا لتسجيل مكاسب أسبوعية تتجاوز 1.7%، وذلك بعد أن أبطلت المحكمة العليا الأمريكية الرسوم الجمركية العالمية التي فرضها الرئيس ترامب.وأدى الحكم إلى موجة صعود في القطاعات المرتبطة بالتجارة، حيث قفز سهم Shopify بنحو 5%، فيما أضاف سهم Constellation Software أكثر من 4%.

قراءة المزيد

GOLD ALSABAEK

20

فبراير

ارتفع مؤشر الدولار الأمريكي إلى مستوى 98.07 نقطة، مسجلًا أعلى مستوى له في أربعة أسابيع، وهو الأعلى منذ يناير 2026.ورغم هذا الارتفاع الأخير، لا يزال US Dollar Index منخفضًا بنحو 0.7% خلال الأسابيع الأربعة الماضية. وعلى أساس سنوي، سجل المؤشر تراجعًا بنسبة 8.02% خلال الاثني عشر شهرًا الماضية، ما يعكس استمرار الضغوط على العملة الأمريكية على المدى الأطول رغم التعافي الأخير.

قراءة المزيد

GOLD ALSABAEK

20

فبراير

يحافظ الذهب على ميله الإيجابي فوق مستوى 5,000 دولار للأوقية لليوم الثالث على التوالي، إلا أن الزخم الصعودي لا يزال محدودًا في ظل حالة الترقب لصدور بيانات اقتصادية أمريكية مهمة.ترقب البيانات الأمريكيةيفضل المتداولون انتظار صدور القراءة الأولية للناتج المحلي الإجمالي للربع الرابع، إضافة إلى مؤشر أسعار نفقات الاستهلاك الشخصي (PCE)، وهو مقياس التضخم المفضل لدى Federal Reserve. وستكون هذه البيانات حاسمة في تشكيل توقعات مسار خفض أسعار الفائدة، ما سينعكس بدوره على تحركات الدولار الأمريكي ويؤثر في أداء المعدن الأصفر غير المدر للعائد.التوترات الجيوسياسية تدعم الذهبعلى الصعيد السياسي، حذر الرئيس الأمريكي Donald Trump إيران من ضرورة التوصل إلى اتفاق بشأن برنامجها النووي خلال مهلة تتراوح بين 10 و15 يومًا، ملوحًا بعواقب وخيمة في حال عدم الامتثال. من جانبها، أبلغت إيران الأمين العام للأمم المتحدة Antonio Guterres أنها لا تسعى إلى الحرب لكنها لن تتسامح مع أي اعتداء عسكري، مؤكدة أن أي قواعد أو أصول لقوة معادية في المنطقة ستكون أهدافًا مشروعة إذا تعرضت لهجوم.

قراءة المزيد

GOLD ALSABAEK

20

فبراير

ارتفعت أسعار الفضة متجاوزة مستوى 78.5 دولارًا للأونصة، مواصلة مكاسبها في ظل إعادة تقييم المستثمرين لتوجهات السياسة الأمريكية، وسط بيانات اقتصادية مرنة وتصاعد المخاطر الجيوسياسية.

قراءة المزيد

GOLD ALSABAEK

19

فبراير

استعاد الذهب مستوى 5000 دولار للأونصة خلال تداولات الخميس، مدعومًا بزيادة الطلب على الملاذات الآمنة في ظل تصاعد التوترات الجيوسياسية، رغم استمرار قوة الدولار الأمريكي التي حدّت من مكاسب المعدن الأصفر.وجاء الارتفاع مع استمرار المخاطر الجيوسياسية، حيث انتهت جولة جديدة من المفاوضات بين روسيا وأوكرانيا دون نتائج حاسمة، إلى جانب تصاعد التوتر مع إيران وسط تقارير عن احتمالات تحرك عسكري أمريكي، ما عزز الإقبال على الذهب.في المقابل، حدّت قوة الدولار من الارتفاعات، بعد صدور محضر اجتماع الاحتياطي الفيدرالي الذي أظهر انقسامًا بين الأعضاء بشأن توقيت خفض أسعار الفائدة، حيث أشار البعض إلى إمكانية الخفض إذا تباطأ التضخم، بينما حذّر آخرون من التسرع في التيسير النقدي.كما دعمت البيانات الاقتصادية الأمريكية القوية، خاصة في قطاعي الصناعة والتصنيع، توجه الفيدرالي للإبقاء على أسعار الفائدة مرتفعة لفترة أطول، ما يعزز الدولار ويضغط على الذهب.وتترقب الأسواق صدور بيانات اقتصادية مهمة تشمل طلبات إعانة البطالة ومؤشرات التصنيع، بالإضافة إلى مؤشر نفقات الاستهلاك الشخصي (PCE) يوم الجمعة، والذي يعد مقياسًا رئيسيًا للتضخم لدى الفيدرالي.📊 فنيًايحافظ الذهب على تداولاته فوق المتوسط المتحرك لـ100 ساعة قرب 4956 دولار، ما يدعم الاتجاه الصاعد على المدى القصير، إلا أن بقاء المؤشرات الفنية في وضع محايد يشير إلى احتمال استمرار التذبذب.📌 الخلاصة – دار السبائكالذهب يستفيد من التوترات الجيوسياسية ويستعيد مستوى 5000 دولار، لكن قوة الدولار والانقسام داخل الفيدرالي قد يحدّان من استمرار الصعود في المدى القريب، مع ترقب بيانات التضخم الأمريكية لتحديد الاتجاه القادم.

قراءة المزيد

GOLD ALSABAEK

18

فبراير

بحسب تحليل J.P. Morgan فإن الحديث عن توقف موجة صعود الذهب له مبررات نظرية، لكن العوامل الداعمة ما زالت أقوى حتى الآن أولاً: ما الذي يدعم استمرار الصعود؟1️⃣ الطلب القوي من البنوك المركزيةمنذ 2022 تضاعفت مشتريات البنوك المركزية، خاصة بعد تجميد الأصول الروسية، حيث سعت الدول لتنويع احتياطياتها بعيدًا عن الدولار الصين تحديدًا ما زالت تملك نسبة ذهب منخفضة نسبيًا ضمن احتياطياتها مقارنة بالدول المتقدمة، ما يعني وجود مجال لمزيد من الشراء مستقبلاً 2️⃣ التوترات الجيوسياسيةالذهب تاريخيًا يحقق متوسط عائد إيجابي خلال الأزمات الكبرى ويتفوق على أصول أخرى عند تصاعد المخاطر 3️⃣ التحوط من التضخم وضعف العملاتالذهب يُستخدم كأداة حماية من تآكل قيمة العملات ومن المخاطر المالية طويلة الأجل 4️⃣ توقعات 2026تقديرات البنك تشير إلى استمرار مشتريات البنوك المركزية بمتوسط قوي خلال 2026، ما يعزز الاتجاه الصاعد طويل الأجل

قراءة المزيد

GOLD ALSABAEK

17

فبراير

تراجع الذهب خلال تداولات الثلاثاء ليتداول دون مستوى 5000 دولار للأونصة متأثرا بانخفاض أحجام التداول بسبب عطلات الأسواق العالمية في حين حدت التوترات الجيوسياسية وتراجع عوائد السندات الأمريكية من وتيرة الهبوط حيث سجل مستوى 4935 دولار بعد أن لامس أدنى مستوى له في نحو أسبوعين عند 4859 دولار بانخفاض يومي يقارب 1.10 بالمئة وجاء الضغط نتيجة انخفاض السيولة مع إغلاق الصين وعدة أسواق آسيوية بمناسبة رأس السنة القمرية إضافة إلى عطلة يوم الرؤساء في الولايات المتحدة ورغم ذلك لم يشهد الذهب موجة بيع قوية بسبب توقف تعافي مؤشر الدولار قرب مستوى 97.12 وتراجع عائد السندات الأمريكية لأجل عشر سنوات إلى 4.02 بالمئة وهو أدنى مستوى منذ أواخر نوفمبر كما تواصل التوترات بين الولايات المتحدة وإيران دعم الطلب على الذهب كملاذ آمن خاصة مع استمرار المحادثات النووية في جنيف وإجراء مناورات عسكرية في مضيق هرمز.

قراءة المزيد

GOLD ALSABAEK

17

فبراير

تراجعت أسعار العقود الآجلة للذهب والفضة مع ارتفاع الدولار خلال تعاملات الثلاثاء، في ظل ترقب الأسواق للمحادثات بين إيران والولايات المتحدة بشأن برنامج طهران النووي، المقرر عقدها اليوم، بعدما قال الرئيس الأمريكي "دونالد ترامب" إن طهران ترغب في التوصل لاتفاق.وانخفضت أسعار العقود الآجلة للمعدن الأصفر تسليم أبريل بنسبة 2.75% أو 139 دولارًا عند 4907.30 دولار للأونصة.وهبط سعر التسليم الفوري للذهب بنسبة 2% عند 4889.9 دولار للأوقية، وخسر نظيره للفضة نحو 3% ليتداول عند 74.30 دولار للأونصة.بينما ارتفع مؤشر الدولار -الذي يقيس أداء العملة الأمريكية أمام سلة من ست عملات رئيسية- بنسبة 0.2% ليتداول عند 97.09 نقطة.وتراجعت العقود الآجلة للفضة تسليم مارس بنسبة 5.3% عند 73.85 دولار للأونصة، فيما هبطت الأسعار الفورية للبلاتين بنحو 2.15% عند 2001.52 دولار، ونظيرتها للبلاديوم 2.25% عند 1688.79 دولار.ومن المقرر أن يلتقي ممثلو أوكرانيا وروسيا في جنيف يومي الثلاثاء والأربعاء في جولة جديدة من محادثات السلام التي تتوسط فيها الولايات المتحدة، بحسب "رويترز".

قراءة المزيد

GOLD ALSABAEK

14

فبراير

تباطأ معدل التضخم السنوي في الولايات المتحدة إلى 2.4% في يناير 2026، مسجّلًا أدنى مستوى له منذ مايو، مقارنة بـ 2.7% في كل من الشهرين السابقين، وأقل من التوقعات التي أشارت إلى 2.5%.ويعكس هذا التباطؤ بشكل رئيسي تأثيرات الأساس، مع خروج قراءات مرتفعة من العام الماضي من الحساب السنوي. وعلى أساس شهري، ارتفع مؤشر أسعار المستهلكين (CPI) بنسبة 0.2%، مقارنة بـ 0.3% في ديسمبر، وأقل من التوقعات البالغة 0.3%.وسجّل مؤشر تكاليف السكن ارتفاعًا بنسبة 0.2%، ليكون العامل الأكبر في الزيادة الشهرية لمؤشر الأسعار العام.وفيما يتعلق بالتضخم الأساسي، تراجع معدل التضخم الأساسي السنوي إلى 2.5%، وهو أدنى مستوى له منذ مارس 2021، مقارنة بـ 2.6% في الشهر السابق، ومتوافقًا مع توقعات الأسواق. وعلى أساس شهري، ارتفع التضخم الأساسي بنسبة 0.3%، أعلى قليلًا من الزيادة المسجلة في ديسمبر والبالغة 0.2%.

قراءة المزيد

GOLD ALSABAEK

13

فبراير

تراجعت أسعار الذهب بنحو 2.7% يوم الخميس، رغم انخفاض عوائد سندات الخزانة الأميركية وصدور بيانات قوية لسوق العمل، في ظل غياب محفز واضح يدعم الأسعار.وتداول المعدن النفيس قرب 4945 دولارًا للأونصة بعد أن لامس مستوى 5100 دولارات في وقت سابق من الجلسة، قبل أن يتعرض لضغوط بيعية حادة دفعته دون مستوى 4900 دولار.ضغوط متعددةجاء تراجع الذهب في ظل:قوة الدولار الأميركيتقليص توقعات خفض أسعار الفائدة في يوليوتراجع الطلب على الملاذات الآمنة مع انحسار التوترات الجيوسياسية، خاصة مع تنامي التفاؤل بشأن المحادثات المتعلقة بروسيا وإيرانكما دعمت تقارير تشير إلى نية روسيا استئناف تسوية بعض معاملاتها بالدولار الأميركي العملة الأميركية، ما زاد من الضغوط على الذهب.بيانات سوق العملأظهرت بيانات وزارة العمل الأميركية أن طلبات إعانة البطالة الأولية للأسبوع المنتهي في 7 فبراير ارتفعت إلى 227 ألف طلب، متجاوزة التوقعات البالغة 222 ألفًا، لكنها ظلت أقل من القراءة السابقة، مع استقرار المتوسط المتحرك لأربعة أسابيع عند نحو 219.5 ألف طلب.في المقابل، جاءت بيانات الوظائف غير الزراعية لشهر يناير قوية، إذ أضاف الاقتصاد الأميركي 130 ألف وظيفة، أي ما يقارب ضعف التوقعات البالغة 70 ألفًا، بينما تراجع معدل البطالة إلى 4.3% من 4.4%.تأثير السياسة النقديةعززت متانة سوق العمل توجه الاحتياطي الفيدرالي للإبقاء على أسعار الفائدة دون تغيير، وفقًا لما تعكسه تسعيرات الأسواق. كما قلصت الأسواق رهاناتها على خفض الفائدة في يونيو، مع ارتفاع احتمالات خفضها في اجتماع يوليو.وتشير بيانات الأسواق إلى تسعير نحو 30 نقطة أساس من التيسير النقدي بحلول اجتماع 29 يوليو.ورغم تراجع عوائد السندات الأميركية، فإن قوة الدولار وتقليص توقعات التيسير النقدي حدّا من جاذبية الذهب، الذي يتأثر عادة بتحركات العملة الأميركية وتوقعات أسعار الفائدة.

قراءة المزيد

GOLD ALSABAEK

13

فبراير

تراجعت أسعار الفضة بنحو 10% لتتداول دون مستوى 76 دولارًا للأونصة، مواصلةً انعكاسًا حادًا في الاتجاه، مع موجة تسييل واسعة في الأسواق المالية دفعت المستثمرين إلى بيع المعادن النفيسة لتوفير السيولة.وجاء تسارع الهبوط رغم تراجع عوائد سندات الخزانة الأميركية إلى أدنى مستوياتها في عدة أشهر، ما يشير إلى أن التحرك كان مدفوعًا بدرجة أكبر بضغوط السيولة وتسارع فك المراكز الاستثمارية، عقب موجة صعود ممتدة شهدها المعدن مؤخرًا، وليس بإعادة تسعير توقعات أسعار الفائدة فقط.وامتدت الضغوط البيعية إلى سلع أخرى، حيث تكبد كل من الذهب والنحاس خسائر ملحوظة، في دلالة على وجود ضغوط عابرة للسلع داخل الأسواق العالمية.ورغم استمرار توقعات الأسواق بصدور بيانات تضخم أضعف، وتسعير احتمال خفض الاحتياطي الفيدرالي أسعار الفائدة مرتين خلال العام الجاري، فإن التدفقات الفورية كانت مدفوعة بعمليات خفض الرافعة المالية (Deleveraging).كما ساهمت الطبيعة المزدوجة للفضة، باعتبارها معدنًا نقديًا وصناعيًا في آن واحد، في تضخيم حدة التقلبات، خاصة في ظل المخاوف المتعلقة بتباطؤ النمو العالمي.وعلى الرغم من موجة الهبوط الحادة، لا تزال عوائد السندات المنخفضة والطلب التحوطي طويل الأجل المرتبط بحالة عدم اليقين المالي تشكلان عوامل دعم هيكلية للأسعار، بمجرد انحسار ضغوط البيع القسري.

قراءة المزيد

GOLD ALSABAEK

11

فبراير

ارتفعت أسعار الذهب خلال تعاملات يوم الأربعاء، مدعومة بتراجع الدولار الأمريكي، حيث جرى تداول زوج قرب مستوى 5103 دولارات للأونصة، بارتفاع يقارب 1.45%، مع تركّز أنظار الأسواق على تقرير الوظائف الأمريكي (NFP) المؤجّل.ومن المقرر صدور تقرير أوضاع التوظيف لشهر يناير عند الساعة 13:30 بتوقيت غرينتش، بعد تأجيله بسبب الإغلاق الجزئي للحكومة الأمريكية. وتشير التوقعات إلى إضافة نحو 70 ألف وظيفة خلال يناير، مقارنة بـ 50 ألف وظيفة في ديسمبر. كما يُتوقع ارتفاع متوسط الأجور في الساعة بنسبة 0.3% على أساس شهري و3.6% على أساس سنوي، مع استقرار معدل البطالة عند 4.4%.وقد يمنح التقرير اتجاهًا جديدًا لأسعار الذهب؛ إذ إن أي مفاجأة سلبية في بيانات التوظيف أو الأجور ستعزز التوقعات باستئناف الاحتياطي الفيدرالي خفض أسعار الفائدة في وقت أقرب، ما قد يزيد الضغط على الدولار ويدعم المعدن الذي لا يدرّ عائدًا.

قراءة المزيد

GOLD ALSABAEK

10

فبراير

تواجه الحكومة الأميركية خطر إغلاق جزئي جديد مع اقتراب نهاية الأسبوع الجاري، في ظل استمرار الخلافات بين الديمقراطيين والجمهوريين بشأن الإصلاحات المحتملة لممارسات تطبيق قوانين الهجرة التي أقرتها إدارة الرئيس دونالد ترامب.ويأتي هذا التطور بعد إغلاق جزئي سابق استمر من 31 يناير حتى 3 فبراير، وانتهى عقب توصل الحزبين إلى حزمة إنفاق مؤقتة وفرت تمويلًا لمدة أسبوعين لوزارة الأمن الداخلي، التي تشرف على وكالة الهجرة والجمارك الأميركية (ICE).ومن المقرر أن تنتهي صلاحية هذا التمويل المؤقت بنهاية الأسبوع، ما يعني أن توقف التمويل عن وزارة الأمن الداخلي قد يبدأ اعتبارًا من يوم السبت، في حال عدم التوصل إلى اتفاق جديد.ولا تزال المفاوضات متعثرة حتى الآن، إذ لم تُحرز أي تقدم ملموس بشأن الخلافات المتعلقة بممارسات وكالة الهجرة والجمارك، ما يزيد من احتمالات دخول الحكومة في إغلاق جزئي جديد.

قراءة المزيد

GOLD ALSABAEK

09

فبراير

اتهم وزير الخزانة الأميركي سكوت بيسنت المتداولين في الصين بالوقوف وراء التقلبات الحادة التي شهدتها أسواق الذهب خلال الأسبوع الماضي، في أعقاب الارتفاعات القياسية التي سجلها المعدن النفيس.وفي مقابلة مع شبكة فوكس نيوز، قال بيسنت، ردًا على سؤال حول القفزة الكبيرة في أسعار المعادن النفيسة:«بالنسبة لتحركات الذهب، أصبحت الأمور مضطربة بعض الشيء في الصين، ما دفع الجهات المعنية إلى تشديد متطلبات الهامش، ويبدو أن ما نشهده هو تقلبات ذات طابع مضاربي حاد».وأشار وزير الخزانة الأميركي إلى أن هذه الإجراءات تعكس محاولات لاحتواء نشاطات المضاربة، في ظل الارتفاعات السريعة وغير المستقرة التي شهدها سوق الذهب مؤخرًا.وفي سياق منفصل، تطرق بيسنت إلى استقلالية الاحتياطي الفيدرالي، موضحًا أن كيفن وارش، مرشح الرئيس الأميركي لقيادة البنك المركزي خلفًا لـ جيروم باول، سيكون «مستقلًا للغاية»، لكنه في الوقت نفسه «سيدرك أن الاحتياطي الفيدرالي مسؤول أمام الشعب الأميركي».

قراءة المزيد

GOLD ALSABAEK

09

فبراير

ارتفعت أسعار العقود الآجلة للذهب والفضة خلال تداولات يوم الإثنين، مع ترقب الأسواق صدور العديد من البيانات الاقتصادية الأمريكية المهمة في وقت لاحق من الأسبوع، وذلك لاستشراف آفاق السياسة النقدية.

قراءة المزيد

GOLD ALSABAEK

09

فبراير

شهدت أسعار الذهب في الأسواق العالمية ارتفاعًا قويًا مع انطلاق تعاملات اليوم، حيث تجاوز سعر الأونصة مستوى 5000 دولار في التداولات المبكرة، مسجلًا مستوى قياسيًا غير مسبوق في تاريخ المعدن النفيس.وبحسب بيانات الأسواق، قفز سعر الذهب الفوري ليسجل نحو 5080 دولارًا للأونصة بعد افتتاح التداولات، في استمرار لمسار الصعود الذي يشهده المعدن الأصفر منذ نهاية العام الماضي، مدفوعًا بتزايد الإقبال على الملاذات الآمنة.العوامل الدافعة للارتفاع:تصاعد التوترات الجيوسياسية والاقتصادية عالميًا، ما عزز توجه المستثمرين نحو الذهب.تراجع الدولار الأميركي نسبيًا أمام سلة العملات الرئيسية، الأمر الذي زاد من جاذبية المعدن النفيس للمستثمرين الدوليين.استمرار الطلب القوي من المستثمرين وصناديق التحوط والبنوك المركزية على الذهب كأداة تحوط طويلة الأجل.السوق الآجلة والتوقعات:كما سجلت العقود الأميركية الآجلة للذهب ارتفاعًا ملحوظًا مع بداية التداولات، وسط توقعات بأن يواصل المعدن النفيس تماسكه عند مستويات مرتفعة خلال الفترة المقبلة، في حال استمرار العوامل الداعمة الحالية.

قراءة المزيد

GOLD ALSABAEK

06

فبراير

قررت مجموعة «سي إم إي»، المشغّل لأكبر بورصة للسلع في العالم، رفع متطلبات هامش الضمان لعقود الذهب والفضة الآجلة للمرة الثالثة خلال فترة قصيرة، في خطوة تهدف إلى الحد من المخاطر الناتجة عن التقلبات السعرية الحادة، وضمان قدرة المستثمرين على تغطية مراكزهم المالية.وبموجب القرار، تم رفع هامش الضمان الأولي لعقود الذهب في بورصة «كومكس» إلى 9% بدلًا من 8%، كما تم رفع هامش الضمان لعقود الفضة إلى 18% مقارنة بـ 15% سابقًا، على أن تدخل التعديلات حيز التنفيذ بعد تسوية تداولات اليوم

قراءة المزيد

GOLD ALSABAEK

05

فبراير

حافظت أسعار الفضة على تداولها فوق مستوى 89 دولارًا للأونصة يوم الأربعاء، بعدما قلّصت مكاسبها المبكرة، في وقت تقيّم فيه الأسواق البيانات الاقتصادية الأمريكية وتأثيرها المحتمل على توجهات السياسة النقدية للاحتياطي الفيدرالي، عقب ترشيح الرئيس دونالد ترامب لكيفن وورش لرئاسة البنك المركزي.ومع تأجيل صدور تقارير رئيسية عن سوق العمل هذا الأسبوع، انصبّ تركيز المستثمرين على بيانات القطاع الخاص، حيث أظهر تقرير ADP نموًا أضعف من المتوقع في الوظائف، ما عزز الرهانات على تباطؤ اقتصادي نسبي. في المقابل، جاء مؤشر ISM لقطاع الخدمات أقوى من التوقعات، مشيرًا إلى استمرار الزخم في النشاط الخدمي بالولايات المتحدة.

قراءة المزيد

GOLD ALSABAEK

05

فبراير

سجّلت أسعار الذهب ارتفاعًا قويًا خلال تداولات يوم الأربعاء، لتخترق حاجز 5100 دولار للأونصة، مدفوعة بتزايد الإقبال على المعدن الأصفر كملاذ آمن، في ظل تصاعد التوترات الجيوسياسية بين الولايات المتحدة وإيران، وما صاحبها من حالة عدم يقين في الأسواق العالمية.وارتفعت العقود الآجلة للذهب تسليم أبريل بنسبة 3.5% أو ما يعادل 173.10 دولار، لتصل إلى 5108.10 دولار للأونصة، فيما صعد السعر الفوري للذهب بنسبة 2.7% ليسجل 5079.36 دولار للأونصة.وعلى صعيد المعادن الأخرى، قفزت أسعار الفضة بشكل لافت، حيث ارتفعت العقود الآجلة تسليم مارس بنسبة 5.35% إلى 87.76 دولار للأونصة، كما صعدت الأسعار الفورية للفضة بنحو 3.35% لتتداول قرب 88.01 دولار للأونصة، في إشارة إلى عودة الزخم القوي للمعادن الثمينة.في المقابل، تراجع مؤشر الدولار الأمريكي – الذي يقيس أداء العملة أمام سلة من ست عملات رئيسية – بنسبة طفيفة بلغت 0.1% ليستقر عند 97.34 نقطة، ما وفر دعمًا إضافيًا لأسعار الذهب والمعادن المقومة بالدولار.

قراءة المزيد

GOLD ALSABAEK

03

فبراير

تشهد أسواق الذهب حالة من التقلبات الحادة خلال الفترة الأخيرة، إلا أن محللي بنك أوف أمريكا يرون أن العوامل الداعمة للمعدن النفيس لا تزال قوية بما يكفي لدفع أسعاره إلى تجاوز مستوى 6000 دولار للأونصة خلال الأشهر القليلة المقبلة، في واحدة من أكثر التوقعات جرأة في الأسواق العالمية.وقال مايكل ويدمر، المحلل الاستراتيجي لدى بنك أوف أمريكا، في مذكرة بحثية حديثة، إن البنك يدرك المخاوف المرتبطة بوتيرة الارتفاع المتوقعة في أسعار الذهب، إلا أن التجارب السابقة تشير إلى أن موجات الصعود الأخيرة لم تتوقف نتيجة التشبع الشرائي، بل بسبب تراجع مؤقت في العوامل التي عززت جاذبية المعادن النفيسة.

قراءة المزيد

GOLD ALSABAEK

02

فبراير

سجّل مؤشر الدولار ارتفاعًا نحو مستوى 97.5 مع أولى جلسات التداول في شهر فبراير، وهو أعلى مستوى له منذ أكثر من أسبوع، مواصلًا مكاسبه التي تجاوزت 0.7% في الجلسة السابقة. ويأتي هذا الصعود بعد أداء سلبي للدولار خلال شهر يناير.وجاء الدعم الرئيسي للعملة الأمريكية عقب إعلان الرئيس الأمريكي دونالد ترامب ترشيح كيفن وورش لرئاسة مجلس الاحتياطي الفيدرالي، ما أثار حالة من عدم اليقين بشأن مستقبل السياسة النقدية. وتنظر الأسواق إلى وورش على أنه مرشح أكثر تشددًا، يُرجّح أن يدعم خفض أسعار الفائدة بوتيرة أبطأ مقارنة بمرشحين آخرين محتملين.كما يُتوقع أن يعمل وورش على تقليص الميزانية العمومية للفيدرالي، وهي خطوة من شأنها تقليص السيولة في الأسواق، ما يدعم الدولار عادةً.إلى جانب ذلك، تلقى الدولار دعمًا إضافيًا من بيانات اقتصادية أمريكية قوية، حيث ارتفع مؤشر معهد إدارة التوريد (ISM) لقطاع التصنيع بشكل غير متوقع إلى أعلى مستوياته منذ عام 2022 خلال شهر يناير.وعلى صعيد العملات، حقق الدولار مكاسب أمام الين الياباني، كما ارتفع مقابل الفرنك السويسري والدولار الكندي واليورو، في ظل تزايد إقبال المستثمرين على العملة الأمريكية.

قراءة المزيد

GOLD ALSABAEK

31

يناير

قال الرئيس الأميركي دونالد ترامب إنه سيكشف صباح اليوم الجمعة عن مرشحه الجديد لرئاسة مجلس الاحتياطي الفيدرالي، مؤكداً أنه اختار «شخصاً بارزاً ومحترماً ومعروفاً في الأوساط المالية».ويأتي الإعلان المرتقب في وقت يواصل فيه ترامب الضغط على البنك المركزي الأميركي لخفض أسعار الفائدة بوتيرة أسرع، منتقداً النهج الحذر الذي يتبعه الرئيس الحالي للاحتياطي الفيدرالي جيروم باول.

قراءة المزيد

GOLD ALSABAEK

30

يناير

تشهد أسواق الذهب العالمية حاليًا حالة من التقلبات الحادة وغير المسبوقة، حيث انخفضت أسعار الذهب بنحو 500 دولار للأونصة بعد أن كانت قد تجاوزت مستوى 5,600 دولار للأونصة. ويعكس هذا التراجع السريع حدة التحركات السعرية خلال فترة زمنية قصيرة، في ظل موجات من المضاربات وجني الأرباح، وليس نتيجة مسار هبوطي تدريجي.وفي ظل هذه التقلبات العنيفة، قامت مجموعة CME (بورصة شيكاغو التجارية) برفع متطلبات الهامش على عقود الذهب الآجلة، في خطوة تهدف إلى الحد من المخاطر الناتجة عن التذبذب المرتفع في الأسعار، وتعزيز حماية المشاركين في السوق من الخسائر المحتملة.عادةً ما تؤدي مثل هذه التحركات القوية في الأسواق إلى إجراءات تنظيمية مؤقتة، تشمل تشديد شروط التداول أو فرض قيود مرحلية، وذلك لضمان استقرار السوق والحفاظ على كفاءة إدارة المخاطر. وتُعد هذه الإجراءات شائعة في فترات عدم اليقين المرتفع، لا سيما في أسواق السلع التي تتأثر بشكل مباشر بالتطورات الاقتصادية والجيوسياسية.وفي الختام، تعكس هذه التطورات حالة من القلق والترقب في الأسواق العالمية، مما يستدعي من المستثمرين توخي الحذر، ومتابعة المستجدات التنظيمية وتحركات الأسعار عن كثب خلال المرحلة المقبلة.

قراءة المزيد

GOLD ALSABAEK

28

يناير

توقع محللو بنك سيتي جروب أن يواصل سعر الفضة موجة الصعود القوية، مرجحين وصول السعر الفوري للمعدن الأبيض إلى مستوى قياسي عند 150 دولارًا للأونصة خلال الأشهر الثلاثة المقبلة، في ظل استمرار زخم الشراء القوي وتفاقم شح المعروض في الأسواق العالمية.وأوضح محللو البنك في مذكرة صدرت يوم الثلاثاء أن الطلب الاستثماري، لا سيما من السوق الصينية، لا يزال يشكل المحرك الرئيسي لارتفاع الأسعار، إلى جانب تراجع الاستثمارات في صناديق المؤشرات المتداولة المدعومة بالفضة، ما يقلل الكميات المتاحة للتداول ويزيد الضغوط الصعودية.وأشار التقرير إلى أن موجة الارتفاع الأخيرة كانت استثنائية، حيث قفز سعر الفضة بنحو 50% خلال شهر واحد، وهو ما يعكس نشاطًا ملحوظًا للمضاربات في أسواق العقود الآجلة، فضلًا عن الإقبال المتزايد على الفضة كأصل تحوّطي في ظل تصاعد المخاطر الجيوسياسية والاقتصادية.وأضاف محللو سيتي جروب أن استمرار ارتفاع الأسعار يعد ضروريًا لدفع حائزي الفضة الحاليين إلى البيع، بما يساعد على تخفيف حالة شح المعروض في السوق الفعلية، مؤكدين أن السلوك السعري للفضة بات أكثر قوة ونشاطًا مقارنة بالذهب، ومن المرجح أن يستمر هذا التفوق النسبي خلال الفترة المقبلة.ولفت التقرير إلى أن الفضة قد تشهد مزيدًا من الصعود في حال عادت نسبة سعر الذهب إلى الفضة إلى المستويات التاريخية المتدنية المسجلة في عام 2011، عند 32 إلى 1، وهو سيناريو قد يدفع سعر الفضة إلى نحو 170 دولارًا للأونصة.ويعكس هذا التقييم نظرة متفائلة لآفاق الفضة على المدى القريب، في وقت تتزايد فيه شهية المستثمرين للأصول الملموسة والملاذات الآمنة، وسط بيئة عالمية تتسم بعدم اليقين وارتفاع مستويات التقلب في الأسواق المالية.

قراءة المزيد

GOLD ALSABAEK

28

يناير

توقع دويتشه بنك ارتفاع أسعار الذهب إلى مستوى 6000 دولار للأوقية خلال العام الجاري، في ظل استمرار توجه المستثمرين لتنويع محافظهم الاستثمارية بعيدًا عن الأصول الأمريكية، مع تصاعد الضبابية الاقتصادية والجيوسياسية عالميًا.وذكر محللو المصرف الألماني في مذكرة نقلتها وكالة رويترز، أن هناك سيناريوهات بديلة قد تدفع أسعار الذهب إلى مستويات أعلى، مشيرين إلى أن وصول الأوقية إلى نحو 6900 دولار قد يكون أكثر اتساقًا مع الأداء القوي الذي شهده المعدن الأصفر خلال العامين الماضيين.

قراءة المزيد

GOLD ALSABAEK

25

يناير

قال الرئيس الأمريكي دونالد ترامب اليوم السبت إنه سيفرض رسوما جمركية 100 بالمئة على جميع الواردات الكندية إذا أبرمت كندا اتفاقا تجاريا مع الصين.وكتب ترامب على منصة تروث سوشال "إذا كان الحاكم كارني يعتقد أنه سيجعل من كندا ‘ميناء لإنزال‘ البضائع والمنتجات الصينية المتجهة إلى الولايات المتحدة، فهو مخطئ تماما... ستأكل الصين كندا حية، وستلتهمها بالكامل، بما في ذلك تدمير أعمالها ونسيجها الاجتماعي وطريقة حياتها العامة.إذا أبرمت كندا اتفاقا مع الصين، فستُفرض عليها فورا رسوم جمركية 100 بالمئة على جميع البضائع والمنتجات الكندية الواردة إلى الولايات المتحدة الأمريكية".

قراءة المزيد

GOLD ALSABAEK

25

يناير

ارتفعت أسعار الذهب يوم الجمعة 23 يناير 2026 حيث صعد السعر الفوري للسبائك إلى 4,988 دولارا للأونصة بينما سجلت العقود الآجلة مستوى قياسيا عند 4,989.54 دولار للأونصة كما حققت الفضة قمة جديدة متجاوزة 101 دولار للأوقيةوجاء هذا الارتفاع القوي مدفوعا بعدة عوامل رئيسية أبرزها ما يليسياسات البنوك المركزية: خفض الفائدة يدعم الذهبتسعّر الأسواق خفضين على الأقل لأسعار الفائدة من قبل الاحتياطي الفيدرالي خلال عام 2026 ما خفّض تكلفة الفرصة البديلة للاحتفاظ بالذهب وعزز جاذبيته الاستثمارية مع ضعف الدولار الأمريكيكما جاءت بيانات التوظيف الأمريكية الأخيرة أضعف من المتوقع حيث أضيف 50 ألف وظيفة فقط في ديسمبر مقابل توقعات بـ66 ألفا ما عزز رهانات التيسير النقدي ودعم ارتفاع الذهب

قراءة المزيد

GOLD ALSABAEK

23

يناير

سجلت أسعار الفضة مستوى قياسيا جديدا عند 98.5 دولار للأونصة مع إعادة المستثمرين تقييم قوة النمو الاقتصادي في الولايات المتحدة إلى جانب مؤشرات على بقاء ضغوط التضخم تحت السيطرةوجاء ذلك في وقت عزز فيه رفع تقديرات نمو الناتج المحلي الإجمالي الأمريكي للربع الثالث إلى 4.4 بالمئة الرأي القائل إن الاقتصاد لا يزال قويا ما قلل من الحاجة إلى تيسير نقدي قريب الأجل إلا أن بيانات التضخم الأخيرة أشارت إلى استمرار مسار التباطؤ التدريجي دون عودة لارتفاع مفرط في الأسعار وهو ما ساعد على استقرار توقعات السياسة النقدية المستقبلية

قراءة المزيد

GOLD ALSABAEK

23

يناير

واصل الذهب ارتفاعه لليوم الرابع على التوالي مسجلًا مستوى قياسيًا جديدًا فوق 4900 دولار للأونصة رغم تحسن شهية المخاطر في الأسواق العالمية وتراجع التوترات بين الولايات المتحدة وأوروبا حيث بلغ أعلى مستوى عند 4916 دولارات للأونصة ويتم تداوله حاليًا قرب 4915 دولارات بارتفاع يومي يقارب 1.6% ويعكس هذا الأداء استمرار الطلب على الذهب كملاذ آمن في ظل حالة عدم اليقين المتعلقة بالسياسات الاقتصادية والتجارية العالمية رغم الأجواء الإيجابية في الأسواق بعد المحادثات بين الرئيس الأمريكي Donald Trump والأمين العام لحلف NATO

قراءة المزيد

GOLD ALSABAEK

21

يناير

واصل الذهب تسجيل مستويات قياسية جديدة لليوم الثالث على التوالي، متجاوزًا حاجز 4850 دولارًا للأونصة خلال تعاملات يوم الأربعاء، في ظل تصاعد التوترات الجيوسياسية ومخاوف اندلاع حرب تجارية، ما عزز الطلب على المعدن النفيس كملاذ آمن. وجاء هذا الارتفاع مدفوعًا بشكل رئيسي بتفاقم الخلافات المرتبطة بغرينلاند، إلى جانب ضعف الدولار الأمريكي وارتفاع التقلبات في الأسواق العالمية.وأكد الرئيس الأمريكي دونالد ترامب، خلال مشاركته في المنتدى الاقتصادي العالمي في دافوس، تمسكه بخطته للاستحواذ على غرينلاند، معتبرًا أن الجزيرة ذات أهمية استراتيجية للأمن القومي الأمريكي في منطقة القطب الشمالي. وفي المقابل، دعا رئيس وزراء غرينلاند المواطنين إلى الاستعداد لاحتمال تحرك عسكري، رغم تأكيده أن هذا السيناريو لا يزال غير مرجح، ما ساهم في زيادة القلق في الأسواق ودفع المستثمرين نحو الأصول الآمنة.

قراءة المزيد

GOLD ALSABAEK

21

يناير

سجّل الذهب مستوى قياسيًا جديدًا يوم الثلاثاء، متجاوزًا الحاجز النفسي 4,750 دولارًا للأونصة، مدفوعًا بتصاعد التوترات الجيوسياسية التي عززت الطلب القوي على أصول الملاذ الآمن. وفي وقت كتابة التقرير، جرى تداول الذهب قرب 4,765 دولارًا، محافظًا على مستوياته دون أعلى قمة تاريخية جديدة بقليل عند 4,766 دولارًا.

قراءة المزيد

GOLD ALSABAEK

21

يناير

واصل اليورو مكاسبه فوق 1.17 دولار، مسجلاً أعلى مستوى له منذ 6 يناير، وسط ترحيب المستثمرين ببيانات اقتصادية ألمانية فاقت التوقعات، بينما استمرت التوترات الجيوسياسية في الضغط على الدولار الأمريكي.قفز مؤشر ZEW الألماني لثقة المستثمرين إلى 59.6 نقطة في يناير، وهو أعلى مستوى له منذ يوليو 2021، متجاوزاً التوقعات التي كانت تشير إلى 50 نقطة، مما يعكس تفاؤلاً بانتعاش اقتصادي بحلول عام 2026 رغم حالة عدم اليقين التي تكتنف السياسة التجارية الأمريكية. في غضون ذلك، تراجع الدولار عقب تجدد تهديدات الرئيس الأمريكي دونالد ترامب بفرض تعريفات جمركية بنسبة 10% على عدة دول أوروبية للضغط على الدنمارك لبيع غرينلاند للولايات المتحدة.

قراءة المزيد

GOLD ALSABAEK

21

يناير

ارتفعت أسعار الذهب والفضة إلى مستويات قياسية جديدة، مع اتجاه المستثمرين نحو الأصول الآمنة وسط تصاعد التوترات الجيوسياسية، عقب تهديد الرئيس الأمريكي دونالد ترامب بفرض رسوم جمركية إضافية على دول أوروبية على خلفية النزاع المتعلق بـ غرينلاند.وخلال تداولات يوم الثلاثاء، صعدت العقود الآجلة للذهب تسليم فبراير بنسبة 2.65%، أو ما يعادل 121.10 دولارًا، لتصل إلى 4,716.50 دولار للأونصة، بعدما لامست 4,723.40 دولار، وهو أعلى مستوى على الإطلاق للعقود الآجلة الأكثر نشاطًا.

قراءة المزيد

GOLD ALSABAEK

21

يناير

واصل الذهب تسجيل قمم تاريخية جديدة يوم الثلاثاء، مدعومًا بطلب قوي على الملاذات الآمنة، ليرتفع لليوم الثاني على التوالي ويتجاوز مستوى 4,700 دولار للأونصة، مسجلًا أعلى سعر له على الإطلاق خلال جلسة التداول الآسيوية.ولا تزال الحرب الممتدة بين روسيا وأوكرانيا تُبقي المخاطر الجيوسياسية قائمة، وهو ما عوّض تراجع حدة الاضطرابات الداخلية في إيران التي قللت من احتمالات تدخل عسكري أمريكي. وإلى جانب ذلك، أسهمت المخاوف المتزايدة من اندلاع حرب تجارية بين الولايات المتحدة وأوروبا، في ظل تصاعد التوترات بشأن جزيرة غرينلاند، في الضغط على معنويات المستثمرين ودعم الطلب على الذهب كملاذ آمن.

قراءة المزيد

GOLD ALSABAEK

20

يناير

مسجلةً مستوى قياسيًا جديدًا، حيث أقبل المستثمرون على الأصول الآمنة عقب إعلان الرئيس ترامب فرض تعريفات جمركية جديدة على الدول الأوروبية. يوم السبت،قال ترامب إنه سيفرض تعريفة جمركية بنسبة 10% على سلع من ثماني دول أوروبية ابتداءً من 1 فبراير، وقد ترتفع إلى 25% في يونيو إذا لم يتم التوصل إلى اتفاق بشأن ما وصفه بـ"الشراء الكامل والنهائي لغرينلاند". أثار هذا الإعلان مخاوف في جميع أنحاء أوروبا، ومن المتوقع أن يعقد القادة الأوروبيون اجتماعًا طارئًا في الأيام المقبلة لمناقشة إجراءات انتقامية محتملة، بما في ذلك فرض رسوم على سلع أمريكية بقيمة 93 مليار يورو.واصل الذهب ارتفاعه القوي هذا العام بعد أداء متميز في عام 2025، مدعومًا بتدفقات الأصول الآمنة وسط التوترات الجيوسياسية في فنزويلا وإيران، إلى جانب تجدد المخاوف بشأن استقلالية مجلس الاحتياطي الفيدرالي

قراءة المزيد

GOLD ALSABAEK

20

يناير

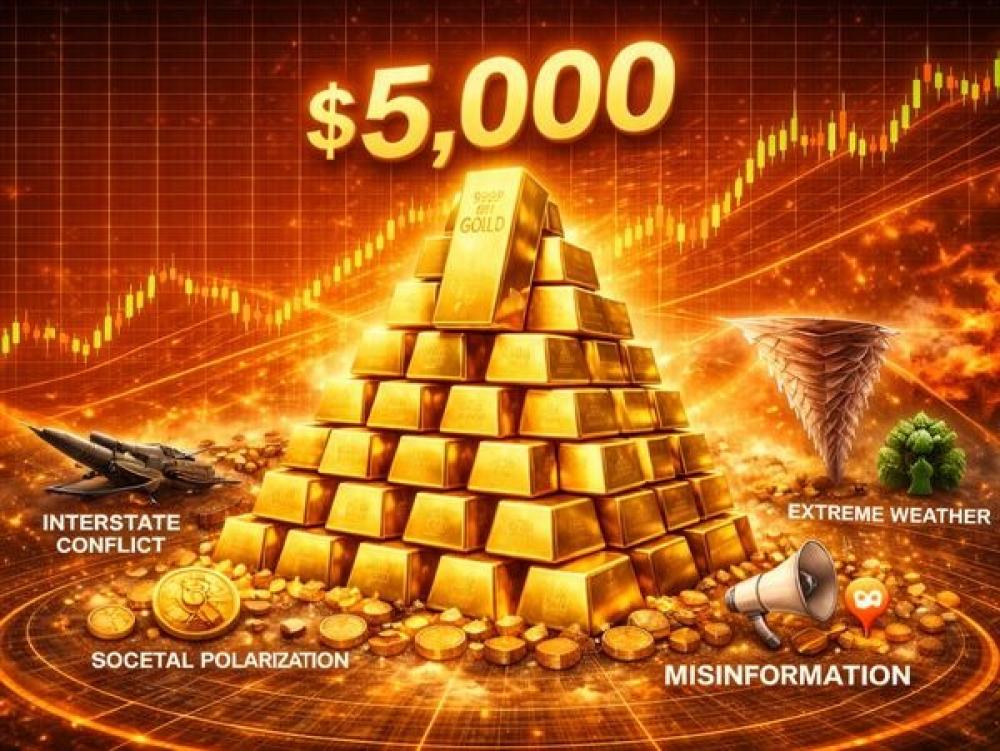

لا يزال سوق الذهب يجذب اهتمامًا كبيرًا مع سعي المستثمرين إلى التحوط من حالة عدم اليقين الجيوسياسي. وقد يحافظ المعدن النفيس على اتجاهه الصاعد القوي، في ظل تصنيف قادة الاقتصاد العالمي للمواجهة الجيو-اقتصادية كأكبر خطر يواجه العالم هذا العام، تليها النزاعات بين الدول، والظواهر المناخية المتطرفة، والاستقطاب المجتمعي، إضافة إلى التضليل والمعلومات المضللة، وذلك وفقًا لأحدث تقرير صادر عن المنتدى الاقتصادي العالمي.ويبدأ المنتدى الاقتصادي العالمي مؤتمره السنوي يوم الاثنين، حيث يتجمع قادة الأعمال والسياسة في دافوس بسويسرا. وقبيل انعقاد المؤتمر، نشر المنتدى تقرير المخاطر العالمية 2026 الذي يعكس قلقًا عميقًا لدى القادة والخبراء.ويأتي هذا المؤتمر الاقتصادي العالمي بعد أيام فقط من إطلاق الرئيس الأميركي دونالد ترامب جولة جديدة من التصعيد في حربه التجارية العالمية المستمرة. ففي منشور على وسائل التواصل الاجتماعي، أعاد ترامب إشعال التوترات مع أوروبا مهددًا بفرض رسوم جمركية بنسبة 10% قد ترتفع إلى 25% على كل من الدنمارك، والنرويج، والسويد، وفرنسا، وألمانيا، والمملكة المتحدة، وهولندا، وفنلندا، في محاولة للضغط عليها لدعم مسعاه لضم غرينلاند.وعقب هذه التهديدات، أعلن أعضاء في البرلمان الأوروبي أنهم سيجمّدون التصديق على الاتفاق التجاري الذي توصل إليه ترامب وأورسولا فون دير لاين، رئيسة المفوضية الأوروبية، في الصيف الماضي.وبحسب استطلاع أجراه المنتدى الاقتصادي العالمي، من المتوقع أن تبقى حالة عدم اليقين الجيوسياسي والاقتصادي عنصرًا أساسيًا في الاقتصاد العالمي.وأشار تقرير المخاطر العالمية إلى أن نحو 50% من أعضاء المنتدى الذين شملهم الاستطلاع يتوقعون عالمًا مضطربًا أو عاصفًا خلال العامين المقبلين، بزيادة قدرها 14 نقطة مئوية عن العام الماضي. ويتوقع 40% آخرون أن تكون الأوضاع غير مستقرة على أقل تقدير، بينما يتوقع 9% الاستقرار و1% فقط يتوقع الهدوء. وعلى مدى السنوات العشر المقبلة، يتوقع 57% عالمًا مضطربًا أو عاصفًا، و32% أوضاعًا غير مستقرة، و10% استقرارًا، و1% فقط هدوءًا.وقال بورغه برنده، رئيس المنتدى الاقتصادي العالمي والرئيس التنفيذي له:«يتشكل نظام تنافسي جديد مع سعي القوى الكبرى لتأمين مناطق نفوذها. هذا المشهد المتغير، حيث يبدو التعاون مختلفًا عمّا كان عليه سابقًا، يعكس واقعًا عمليًا مفاده أن الأساليب التعاونية وروح الحوار تظل ضرورية».وأضاف: «سيكون اجتماعنا السنوي في دافوس منصة حيوية لفهم المخاطر والفرص وبناء الجسور اللازمة للتعامل معها».ويُعد هذا الغموض أحد العوامل الرئيسية التي تفسر توقعات العديد من محللي السلع بوصول أسعار الذهب إلى 5,000 دولار للأونصة وربما تجاوزها خلال النصف الأول من العام. وقد بدأ المعدن النفيس العام بقوة، حيث جرى تداول الذهب الفوري عند 4,671.40 دولار للأونصة، مرتفعًا بنسبة 1.6% خلال اليوم.

قراءة المزيد

GOLD ALSABAEK

19

يناير

لا يزال سوق الذهب يجذب اهتمامًا كبيرًا مع سعي المستثمرين إلى التحوط من حالة عدم اليقين الجيوسياسي. وقد يحافظ المعدن النفيس على اتجاهه الصاعد القوي، في ظل تصنيف قادة الاقتصاد العالمي للمواجهة الجيو-اقتصادية كأكبر خطر يواجه العالم هذا العام، تليها النزاعات بين الدول، والظواهر المناخية المتطرفة، والاستقطاب المجتمعي، إضافة إلى التضليل والمعلومات المضللة، وذلك وفقًا لأحدث تقرير صادر عن المنتدى الاقتصادي العالمي.

قراءة المزيد

GOLD ALSABAEK

19

يناير

قلص الذهب جزءاً من مكاسبه خلال اليوم إلى ما يقارب 4700 دولار، وهو أعلى مستوى تاريخي جديد، إلا أن أي انخفاض تصحيحي ملحوظ يبدو بعيد المنال في ظل بيئة اقتصادية داعمة. هدد الرئيس الأمريكي دونالد ترامب بفرض تعريفات جمركية جديدة على ثماني دول أوروبية عارضت خطته لضم غرينلاند. وقد أثار هذا الإعلان انتقادات حادة من المسؤولين الأوروبيين، وأثار مخاوف بشأن نزاع تجاري أوسع نطاقاً عبر الأطلسي. هذا، إلى جانب تصاعد المخاطر الجيوسياسية

قراءة المزيد

GOLD ALSABAEK

19

يناير

ارتفعت أسعار الذهب والفضة إلى مستويات قياسية جديدة، مع إقبال المستثمرين على الأصول الآمنة وسط تصاعد التوترات الجيوسياسية، بعد تهديد الرئيس الأمريكي "دونالد ترامب" بفرض رسوم جمركية إضافية على الدول الأوروبية بسبب النزاع على "جرينلاند".وخلال تداولات الإثنين، صعدت أسعار العقود الآجلة للمعدن الأصفر تسليم فبراير بنسبة 1.75% أو 80.60 دولار عند 4676 دولارا للأونصة، بعدما لامست 4698 دولارًا، وهو أعلى مستوى للعقود الآجلة الأكثر نشاطًا على الإطلاق.كما ارتفعت العقود الآجلة للفضة تسليم مارس بنسبة 5.3% عند 93.24 دولار للأونصة، بعدما لامست 94.365 دولار، وهو أعلى مستوى على الإطلاق.وزاد سعر التسليم الفوري للذهب بنسبة 1.6% إلى 4669.15 دولار للأونصة، بعد أن لامس مستوى قياسياً بلغ 4689.39 دولار في وقت سابق من الجلسة، وأضاف نظيره للفضة نحو 3.5% عند 93.29 دولار للأونصة، بعد أن سجل أعلى مستوى له على الإطلاق فوق 94 دولارًا.بينما تراجع مؤشر الدولار -الذي يقيس أداء العملة الأمريكية أمام سلة من ست عملات رئيسية- بنسبة 0.25% عند 99.16 نقطة.وفي حين أضافت الأسعار الفورية للبلاتين 0.3% عند 2347.89 دولار، خسرت نظيرتها للبلاديوم نحو 0.5% لتتداول عند 1794.3 دولار.وأفاد دبلوماسيون من الاتحاد الأوروبي بأن سفراء التكتل توصلوا، أمس الأحد، إلى اتفاق مبدئي لتكثيف الجهود الرامية إلى ثني "ترامب" عن فرض رسوم جمركية على الحلفاء الأوروبيين، مع الاستعداد لاتخاذ إجراءات انتقامية، حال فرض هذه الرسوم، بحسب "رويترز".

قراءة المزيد

GOLD ALSABAEK

19

يناير

تراجعت العقود الآجلة الأمريكية على خلفية تهديد ترامب بفرض تعريفات جمركية انخفضت العقود الآجلة للأسهم الأمريكية يوم الاثنين بعد أن هدد الرئيس دونالد ترامب بفرض تعريفات جمركية جديدة على ثماني دول أوروبية لإجبارها على "شراء غرينلاند بالكامل". تستهدف الإجراءات المقترحة ألمانيا والمملكة المتحدة وفرنسا والدنمارك والنرويج والسويد وهولندا وفنلندا، حيث من المقرر أن تدخل تعريفة بنسبة 10% حيز التنفيذ في الأول من فبراير، وترتفع إلى 25% في يونيو ما لم يتم التوصل إلى اتفاق

قراءة المزيد

GOLD ALSABAEK

19

يناير

قفزت أسعار المعادن النفيسة بقوة، حيث وصل الذهب إلى 4690 دولارًا للأونصة، فيما ارتفعت الفضة إلى 93 دولارًا للأونصة، مدعومة بزيادة الطلب على الملاذات الآمنة وتصاعد التقلبات في الأسواق العالمية. ويعكس هذا الارتفاع عودة قوية للطلب الاستثماري على المعادن النفيسة في ظل تصاعد حالة عدم اليقين، مع توجه المستثمرين نحو التحوط من المخاطر وتراجع شهية المخاطرة في الأسواق المالية

قراءة المزيد

GOLD ALSABAEK

18

يناير

تعهد الرئيس الأمريكي دونالد ترامب اليوم السبت بتطبيق موجة من الرسوم الجمركية المتزايدة على الحلفاء الأوروبيين حتى يُسمح لواشنطن بشراء جرينلاند، في تصعيد للخلاف حول مستقبل الجزيرة مترامية الأطراف بالقطب الشمالي التابعة لمملكة الدنمرك.وفي منشور على منصة تروث سوشيال، قال ترامب إن رسوما جمركية بنسبة 10 بالمئة ستدخل حيز التنفيذ في الأول من فبراير شباط على الدنمرك والنرويج والسويد وفرنسا وألمانيا وبريطانيا وهولندا وفنلندا.وأضاف أن الرسوم سترتفع إلى 25 بالمئة في الأول من يونيو حزيران وستستمر حتى يتم التوصل إلى اتفاق يسمح بشراء الولايات المتحدة لجرينلاند.وأكد ترامب مرارا الأهمية البالغة التي تمثلها جرينلاند لأمن الولايات المتحدة نظرا لموقعها الاستراتيجي ووفرة مواردها المعدنية، ولم يستبعد استخدام القوة العسكرية للسيطرة عليها.وأرسلت دول أوروبية خلال الأيام الماضية أعدادا محدودة من العسكريين إلى الجزيرة بناء على طلب الدنمرك.وكتب ترامب قائلا: "هذه الدول، التي تخوض هذه اللعبة الخطيرة، وضعت نفسها في موقف لا يمكن تحمله أو استمراه".وأضاف "أمريكا منفتحة فورا على التفاوض مع الدنمرك و/أو أي من هذه الدول التي تتسبب في الكثير من المخاطر رغم كل ما قدمناه لها، بما في ذلك توفير أقصى درجات الحماية، على مدى عقود طويلة".وتظاهر آلاف في أنحاء الدنمرك وجزيرة جرينلاند اليوم السبت احتجاجا على مطالبة ترامب بضم الجزيرة، ودعوا إلى احترام حق سكانها في تقرير مصيرهم.وأيدت دول في الاتحاد الأوروبي موقف الدنمرك محذرة من أن الاستيلاء الأمريكي عسكريا على إقليم في حلف شمال الأطلسي ربما يؤدي لانهيار الحلف الذي تقوده واشنطن.وعبرت بريطانيا أيضا عن دعمها لموقف الدنمرك.

قراءة المزيد

GOLD ALSABAEK

17

يناير

لوح الرئيس الأمريكي "دونالد ترامب" بإمكانية فرض رسوم جمركية على الدول التي تعارض مساعيه لضم جرينلاند إلى الولايات المتحدة.وقال "ترامب" في تصريحات من البيت الأبيض الجمعة: "نحن بحاجة إلى جرينلاند من أجل الأمن القومي، لذا قد أفعل ذلك".تأتي تصريحات "ترامب" عقب اجتماع مسؤولين من الدنمارك والولايات المتحدة وجرينلاند في البيت الأبيض هذا الأسبوع لبحث قضية ضم الجزيرة، لكنه لم يُفض إلى نتائج ملموسة.

قراءة المزيد

GOLD ALSABAEK

16

يناير

مواصلةً خسائر الجلسة السابقة، مع تراجع الطلب على الملاذات الآمنة وتلاشي التوقعات بخفض أسعار الفائدة من قبل الاحتياطي الفيدرالي على المدى القريب.انخفضت حدة التوترات الجيوسياسية المحيطة بإيران بعد أن أكد الرئيس دونالد ترامب مجددًا أنه قد يؤجل أي عمل عسكري، مشيرًا إلى مؤشرات على انحسار حملة القمع ضد الاحتجاجات وعدم تنفيذ عمليات إعدام واسعة النطاق.في الوقت نفسه، عززت البيانات الاقتصادية الأمريكية القوية الرأي القائل بأن السياسة النقدية ستظل تقييدية لفترة أطول، مما دفع المستثمرين إلى تقليص رهاناتهم على خفض وشيك لأسعار الفائدة من قبل الاحتياطي الفيدرالي. تتوقع الأسواق الآن على نطاق واسع أن تبقى أسعار الفائدة دون تغيير في وقت لاحق من هذا الشهر، مع تأجيل التيسير النقدي الكامل التالي إلى منتصف عام 2026.على الرغم من هذا التراجع، لا يزال الذهب قريبًا من مستويات قياسية، ولا يزال مهيأً لتحقيق مكاسب أسبوعية، مدعومًا بأدائه القوي في وقت سابق من الأسبوع.

قراءة المزيد

GOLD ALSABAEK

16

يناير

تتوقع سيتي غروب ارتفاع أسعار الذهب لتتجاوز 5000 دولار للأونصة خلال الربع الأول من العام، مع وصول سعر الفضة إلى 100 دولار للأونصة. لكن في حين من المرجح أن يستمر أداء الفضة والمعادن الصناعية الأخرى في التفوق، قد تشهد أسعار الذهب انخفاضًا ملحوظًا في وقت لاحق من عام 2026 مع انحسار التوترات العالمية.رفع محللو الاستراتيجيات بقيادة كيني هو توقعاتهم لسعر الذهب خلال الأشهر الثلاثة المقبلة إلى 5000 دولار للأونصة، وسعر الفضة إلى 100 دولار للأونصة، وذلك يوم الثلاثاء، حيث تتوقع الشركة في وول ستريت استمرار السوق الصاعدة للمعادن النفيسة حتى أوائل عام 2026.وأشار المحللون إلى "تزايد المخاطر الجيوسياسية، واستمرار نقص المعروض في السوق، وتجدد حالة عدم اليقين بشأن استقلالية الاحتياطي الفيدرالي" كأسباب لرفع التوقعات.وبينما سجل كلا المعدنين مستويات قياسية جديدة في العام الجديد، أكد سيتي مجدداً توقعاته بتفوق الفضة على الذهب، مع توقعاته بأن تستحوذ المعادن الأساسية على الاهتمام الأكبر في نهاية المطاف.وكتب محللو الاستراتيجيات: "لقد أثبتت توقعاتنا طويلة الأمد بتفوق الفضة وتوسع سوق المعادن النفيسة ليشمل المعادن الصناعية، وتصدر المعادن الصناعية المشهد خلال نفس الفترة، نجاحها".كما أشار المحللون إلى استمرار شح المعروض في السوق المادية، لا سيما في الفضة ومعادن مجموعة البلاتين، موضحين أن التأخيرات والغموض المحيط بقرارات تعريفة المادة 232 للمعادن الحيوية القادمة تشكل "مخاطر ثنائية كبيرة على التدفقات التجارية والأسعار".وحذر سيتي من أنه في حال فرض تعريفات جمركية مرتفعة، قد يتفاقم النقص في المعروض المادي، مما قد يؤدي إلى ارتفاعات حادة في الأسعار، مع ازدياد شحن المعادن إلى الولايات المتحدة. ولكن بمجرد وضوح التعريفات، من المرجح أن تعود هذه المخزونات المعدنية إلى الأسواق الخارجية، مما يخفف من شح المعروض المادي في بقية أنحاء العالم ويضغط على الأسعار نحو الانخفاض.حذّر المحللون الاستراتيجيون من أن "انهيار أسعار الفضة نتيجةً لتدفقات رأس المال الخارجة المدفوعة بـ S232 قد يؤدي إلى عمليات بيع تكتيكية في أسواق المعادن النفيسة الأخرى والمعادن الأساسية"، لكنهم أكدوا أنهم "سينظرون إلى ذلك كفرصة شراء عند انخفاض الأسعار في سوق صاعدة"، لأن العوامل الدافعة للارتفاع في أسعار المعادن لا تزال قائمة.وتفترض توقعات سيتي المُحدّثة انحسار التوترات الجيوسياسية بعد الربع الأول، مما سيؤدي إلى انخفاض الطلب على المعادن النفيسة لاحقًا هذا العام، مع كون الذهب الأكثر عرضةً لتصحيح هبوطي. ومع ذلك، لا يزال البنك يتوقع أداءً جيدًا للمعادن الصناعية، وخاصةً الألومنيوم والنحاس، في النصف الثاني من عام 2026.

قراءة المزيد

GOLD ALSABAEK

13

يناير

ارتفع سعر الفضة إلى ما فوق 88 دولارًا للأونصة لأول مرة يوم الثلاثاء، بعد أن أشارت بيانات التضخم الأمريكية إلى انخفاض ضغوط الأسعار وتقليل مخاطر تشديد السياسة النقدية على المدى القريب.استقر مؤشر أسعار المستهلكين الرئيسي لشهر ديسمبر عند 2.7%، بينما بقي المؤشر الأساسي عند 2.6%، وهو أدنى مستوى له منذ عام 2021، مع انخفاض طفيف في قراءة المؤشر الأساسي الشهري، ما جاء أقل من التوقعات وخفف المخاوف من تسارع التضخم بشكل مستمر.ساهمت هذه الإشارة التضخمية في رفع الطلب على المعادن النفيسة، حيث توقع المستثمرون استمرار السياسة النقدية المتساهلة لفترة أطول. وزاد الإقبال على الشراء مدفوعًا بتدفقات الملاذ الآمن التي تحركت بفعل الأخبار، بعد أنباء عن تحقيق وزارة العدل الأمريكية المتعلق برئيس مجلس الاحتياطي الفيدرالي جيروم باول، وإعلان الرئيس ترامب فرض تعريفة جمركية بنسبة 25% على الدول التي تتعامل تجاريًا مع إيران.

قراءة المزيد

GOLD ALSABAEK

13

يناير

استقر معدل التضخم السنوي في الولايات المتحدة عند 2.7% في ديسمبر 2025، وهو نفس مستوى نوفمبر، ومتوافق مع توقعات السوق.وارتفاع مؤشر الطاقة بنسبة 2.3%، ومؤشر الغذاء بنسبة 3.1%. في الوقت نفسه، بقي المعدل السنوي الأساسي عند 2.6%، وهو أدنى مستوى له منذ عام 2021، مقارنةً بتوقعات ارتفاعه إلى 2.7%. وبالمقارنة مع الشهر السابق، ارتفع مؤشر أسعار المستهلك بنسبة 0.3% كما كان متوقعًا، حيث كانت تكاليف السكن هي العامل الأكبر في الزيادة الشهرية لجميع البنود.

قراءة المزيد

GOLD ALSABAEK

13

يناير

حذر الرئيس "دونالد ترامب" من وقوع "فوضى عارمة" في حال ألغت المحكمة العليا الرسوم الجمركية التي فرضتها إدارته، مسلطاً الضوء على حجم المخاطر المترتبة على هذا القرار المرتقب صدوره يوم الأربعاء، وما سيتبعه من تحديات جسيمة إذا ما تمكنت الشركات من المطالبة باسترداد الرسوم التي دفعتها.وفي منشور له عبر منصة "تروث سوشيال" يعكس قلقه من تداعيات القرار الوشيك، كتب الرئيس: إن المبالغ الفعلية التي سيتعين علينا سدادها، حال أصدرت المحكمة العليا حكماً ضد الولايات المتحدة بشأن الرسوم الجمركية لأي سبب كان، ستصل إلى مئات المليارات من الدولارات.وأوضح "ترامب" أنه عند إضافة المبالغ التي ستطالب بها الدول والشركات تعويضاً عما استثمرته في بناء مصانع ومنشآت وتوفير معدات لتجنب دفع تلك الرسوم، فإن الرقم قد يصل إلى تريليونات الدولارات، محذراً من أن هذه "الفوضى العارمة" سيستحيل على الولايات المتحدة سداد تكلفتها.وأضاف: أي شخص يدعي إمكانية القيام بذلك بسرعة وسهولة، فإنه يقدم إجابة خاطئة أو غير دقيقة، أو مبنية على سوء فهم تام لهذه المسألة المعقدة، واختتم منشوره قائلاً: إذا حكمت المحكمة العليا ضد الولايات المتحدة بشأن هذه المكاسب الهائلة للأمن القومي، فسنكون في ورطة حقيقية.تأتي هذه التصريحات في وقت تطعن فيه شركات ومجموعة من الولايات في "التعريفات الشاملة" التي أعلنها ترامب للمرة الأولى في أبريل 2025، مدعين أن الرئيس قد تجاوز صلاحياته بفرض هذه الرسوم الإضافية على واردات البلاد، وفي حال خسرت الإدارة القضية، قد تضطر الحكومة لرد مليارات الدولارات التي سبق أن حصلتها.

قراءة المزيد

GOLD ALSABAEK

13

يناير

من المرجح أن يكون معدل التضخم السنوي في الولايات المتحدة قد استقر عند 2.7% في ديسمبر 2025، بينما من المحتمل أن يكون المعدل الأساسي قد ارتفع بشكل طفيف إلى 2.7% من 2.6% في نوفمبر، وهو أدنى مستوى له منذ أوائل عام 2021.وعلى أساس شهري، من المتوقع أن يرتفع مؤشر أسعار المستهلك الرئيسي بنسبة 0.3%، مع توقع ارتفاع مؤشر أسعار المستهلك الأساسي بنسبة 0.3% أيضًا، مدفوعًا بشكل رئيسي بارتفاع أسعار السلع.لم ينشر مكتب إحصاءات العمل الأمريكي (BLS) بيانات شهر نوفمبر على أساس شهري، نظرًا لعدم تمكنه من جمع البيانات خلال فترة إغلاق الحكومة.

قراءة المزيد

GOLD ALSABAEK

13

يناير

تراجعت أسعار العقود الآجلة للذهب والفضة، وسط عمليات جني أرباح من قِبل المستثمرين للاستفادة من المكاسب السابقة، في ظل تسجيل مستويات قياسية مرتفعة.وخلال تداولات الثلاثاء، انخفضت أسعار العقود الآجلة للمعدن الأصفر تسليم فبراير بنسبة 0.35% أو 16.40 دولار عند 4598.30 دولار للأونصة.وفي حين تراجع سعر التسليم الفوري للذهب بنسبة 0.2% عند 4589.41 دولار للأونصة، ارتفع نظيره للفضة بنحو 0.25% عند 85.31 دولار للأونصة.بينما ارتفع مؤشر الدولار -الذي يقيس أداء العملة الأمريكية أمام سلة من ست عملات رئيسية- بنسبة 0.15% عند 99 نقطة.كما انخفضت العقود الآجلة للفضة تسليم مارس بنسبة 0.25% عند 84.88 دولار للأونصة، وهبطت الأسعار الفورية للبلاتين بنحو 0.85% عند 2321.66 دولار، ونظيرتها للبلاديوم بنسبة 1.8% عند 1824.64 دولار.ورفَع "سيتي بنك" أهدافه السعرية خلال الأشهر الثلاثة المقبلة للذهب والفضة إلى 5000 دولار و100 دولار للأونصة على التوالي، مُرجِعًا ذلك إلى الزخم القوي في الاستثمارات، إضافةً إلى توقّعه استمرار العوامل الداعمة لارتفاع الأسعار خلال الربع الأول من العام، بحسب "رويترز".

قراءة المزيد

GOLD ALSABAEK

12

يناير

مسجلاً مستويات قياسية جديدة، مدفوعًا بالمخاوف بشأن استقلالية مجلس الاحتياطي الفيدرالي الأمريكي وتصاعد المخاطر الجيوسياسية، مما عزز الطلب على المعادن كملاذ آمن. وقد فتح المدعون الفيدراليون الأمريكيون تحقيقًا جنائيًا مع رئيس مجلس الاحتياطي الفيدرالي، جيروم باول، بشأن شهادته أمام لجنة الخدمات المصرفية في مجلس الشيوخ في يونيو/حزيران الماضي، في حين اتهم باول إدارة ترامب بالضغط على البنك المركزي للتوافق مع توجهاتها السياسية.كما راقبت الأسواق توقعات المزيد من خفض أسعار الفائدة الأمريكية بعد أن أظهر تقرير الوظائف الصادر يوم الجمعة أن نمو التوظيف في ديسمبر كان أقل من التوقعات. ولا يزال المتداولون يتوقعون خفضين من قبل الاحتياطي الفيدرالي هذا العام، على الرغم من التوقعات الواسعة النطاق بأن يُبقي البنك المركزي على سياسته النقدية دون تغيير في وقت لاحق من هذا الشهر. وفي سياق متصل، ظلت التوترات الجيوسياسية مرتفعة مع تصاعد الاحتجاجات في إيران، مما زاد من خطر اندلاع صراع أوسع، حيث تشير التقارير إلى أن الرئيس الأمريكي دونالد ترامب يدرس خيارات للتدخل المحتمل.

قراءة المزيد

GOLD ALSABAEK

12

يناير

وبلغت مستوى قياسيًا جديدًا عند 4600 دولار للأونصة، مدفوعةً بمخاوف بشأن استقلالية مجلس الاحتياطي الفيدرالي وتصاعد المخاطر الجيوسياسية، مما عزز الطلب على الملاذات الآمنة. وكشف رئيس مجلس الاحتياطي الفيدرالي، جيروم باول، يوم الأحد، أنه تلقى تهديدات بتوجيه اتهامات جنائية إليه بسبب شهادته أمام مجلس الشيوخ في يونيو الماضي، منتقدًا هذه الخطوة باعتبارها جزءًا من ضغوط ترامب على مجلس الاحتياطي الفيدرالي لخفض أسعار الفائدة.في غضون ذلك، حذر رئيس البرلمان الإيراني الولايات المتحدة وإسرائيل من أي تدخل بعد تهديد الرئيس ترامب بشن ضربات وسط احتجاجات واسعة النطاق في إيران أسفرت، بحسب التقارير، عن مقتل المئات.وجاء دعم إضافي من توقعات المزيد من خفض أسعار الفائدة الأمريكية بعد أن أظهرت بيانات يوم الجمعة تباطؤ نمو الوظائف في ديسمبر بأكثر من المتوقع.ويتوقع المتداولون خفضين لأسعار الفائدة هذا العام، على الرغم من التوقعات الواسعة بأن يُبقي مجلس الاحتياطي الفيدرالي أسعار الفائدة دون تغيير في وقت لاحق من هذا الشهر. وتركز الأسواق الآن على تقرير التضخم الأمريكي لهذا الأسبوع للحصول على مزيد من المؤشرات حول مسار أسعار الفائدة الذي سيتبعه مجلس الاحتياطي الفيدرالي.

قراءة المزيد

GOLD ALSABAEK

12

يناير

أعلن رئيس مجلس الاحتياطي الفيدرالي "جيروم باول"، خضوعه لتحقيق جنائي من قبل المدعين الفيدراليين بشأن مشروع تجديد مقر البنك المركزي في واشنطن العاصمة، قائلًا إن "إحباط ترامب" بسبب رفضه خفض الفائدة هو الدافع وراء هذه الخطوة.وقال "باول" في بيان نشره في وقت مبكر من صباح الإثنين: "وجهت وزارة العدل، يوم الجمعة، مذكرات استدعاء صادرة عن هيئة محلفين كبرى إلى مجلس الاحتياطي الفيدرالي".وأضاف أن الوزارة لوحت بتوجيه اتهامات جنائية على خلفية شهادته أمام لجنة الشؤون المصرفية في مجلس الشيوخ خلال يونيو الماضي، والتي تناولت – جزئيًا - مشروعًا يمتد لعدة سنوات لتجديد مبانٍ تاريخية تابعة للاحتياطي الفيدرالي.وأردف: "لدي احترام عميق لسيادة القانون ولمبدأ المساءلة في ديمقراطيتنا، ولا أحد فوق القانون، لكن هذا الإجراء غير المسبوق ينبغي النظر إليه في سياق أوسع، يتمثل في تهديدات الإدارة والضغوط المستمرة التي تمارسها".

قراءة المزيد

GOLD ALSABAEK

12

يناير

استقر سعر الذهب عند حوالي 4200 دولار للأونصة يوم الجمعة، مقتربًا من أعلى مستوياته منذ أواخر أكتوبر، منهيًا بذلك موجة صعود سابقة، حيث عززت سلسلة من البيانات الأمريكية احتمالية خفض أسعار الفائدة قريبًا من قبل الاحتياطي الفيدرالي.ارتفع مؤشر نفقات الاستهلاك الشخصي (PCE) المتأخر لشهر سبتمبر بنسبة 0.3% على أساس شهري، و2.8% على أساس سنوي، بينما انخفض مؤشر نفقات الاستهلاك الشخصي الأساسي (CPE) إلى 2.8% من 2.9%، ويعزى ذلك إلى ثبات أسعار السلع وتباطؤ تضخم الخدمات، مما يشير إلى تراجع الضغوط الكامنة.أظهرت نتائج المسح الأولي لولاية ميشيغان تحسنًا طفيفًا إلى 53.3 نقطة، حيث انخفضت توقعات التضخم لعام واحد إلى 4.1%، وانخفضت توقعات التضخم لخمس سنوات إلى 3.2%، مما يعزز الرأي القائل بأن ضغوط الأسعار على المدى القريب آخذة في الانحسار.وقد أدت هذه الإشارات، إلى جانب الانخفاض المفاجئ في أعداد الوظائف في القطاع الخاص بمقدار 32 ألف وظيفة الذي أعلنته شركة ADP، وإعلان تشالنجر عن تسريح 71,321 موظفاً، إلى دفع الأسواق إلى تسعير احتمالات بنحو 87% لخفض الفائدة بمقدار 25 نقطة أساس، مما دفع إلى تعديلات في المواقف أدت إلى رفع سعر الذهب.

قراءة المزيد

GOLD ALSABAEK

11

يناير

أغلقت أسعار الذهب تداولات الأسبوع الماضي عند مستوى 4510 دولارات للأونصة مؤكدة أداءها القوي كملاذ آمن عالمي بعد تحقيق مكاسب أسبوعية تجاوزت 4 بالمئة في واحد من أقوى الأسابيع منذ بداية العام.

قراءة المزيد

GOLD ALSABAEK

10

يناير

سيشهد الأسبوع الثاني الكامل من العام استمرارًا في إصدار بيانات اقتصادية هامة من كبرى الاقتصادات، وبداية موسم إعلان أرباح أكبر البنوك الأمريكية.

قراءة المزيد

GOLD ALSABAEK

10

يناير

مقلصًا خسائره المبكرة، إذ عززت بيانات سوق العمل الأمريكية الضعيفة التوقعات بخفض أسعار الفائدة من قبل الاحتياطي الفيدرالي هذا العام.

قراءة المزيد

GOLD ALSABAEK

10

يناير

ارتفع عائد سندات الخزانة الأمريكية لأجل 10 سنوات مبدئيًا فوق 4.2% قبل أن يتراجع إلى حوالي 4.18% يوم الجمعة، وذلك بعد أن استوعب المتداولون تقريرًا متباينًا عن الوظائف عزز التوقعات بأن الاحتياطي الفيدرالي سيتخذ نهجًا حذرًا في خفض أسعار الفائدة.

قراءة المزيد

GOLD ALSABAEK

10

يناير

أضاف الاقتصاد الأمريكي وظائف بأقل من التوقعات خلال ديسمبر، مع انخفاض معدل البطالة، ما يعني استمرار مرونة سوق العمل في الولايات المتحدة.

قراءة المزيد

GOLD ALSABAEK

07

يناير

بلغت القيمة السوقية للفضة خلال تداولات الأربعاء نحو 4.65 تريليون دولار، لفترة وجيزة، مع ارتفاع الأسعار بنحو 11% منذ بداية العام، في ظل الطلب الصناعي القوي وتوقعات التيسير النقدي في الولايات المتحدة.

قراءة المزيد

GOLD ALSABAEK

05

يناير

يتداول الذهب بميل صعودي مع بداية أول أسبوع تداول كامل من عام 2026

قراءة المزيد

GOLD ALSABAEK

04

يناير

مواصلًا بذلك مساره الصعودي القوي الذي حققه خلال أقوى عام له على الإطلاق. وقفز المعدن النفيس بنسبة 148% العام الماضي

قراءة المزيد

GOLD ALSABAEK

27

ديسمبر

يعد الذهب الخيار الأمثل في سوق السلع الأساسية خلال العام المقبل وإذا انضم المستثمرون الأفراد إلى البنوك المركزية في تنويع محافظهم الاستثمارية

قراءة المزيد

GOLD ALSABAEK

24

ديسمبر

ارتفع سعر الذهب إلى مستوى قياسي جديد خلال تعاملات صباح الثلاثاء في الجلسة الأوروبية المبكرة

قراءة المزيد

GOLD ALSABAEK

18

ديسمبر

تراجعت أسعار العقود الآجلة للذهب قبيل صدور بيانات التضخم في الولايات المتحدة

قراءة المزيد

GOLD ALSABAEK

18

ديسمبر

تحدث الرئيس الأمريكي دونالد ترامب عن تعيينه المرتقب لرئيس جديد لمجلس الاحتياطي الفيدرالي

قراءة المزيد

GOLD ALSABAEK

17

ديسمبر

ارتفعت أسعار الذهب وسجلت الفضة مستوى قياسيًا جديدًا، مع ترقب صدور بيانات التضخم في الولايات المتحدة هذا الأسبوع

قراءة المزيد

GOLD ALSABAEK

16

ديسمبر

تراجعت أسعار النفط خلال تعاملات الثلاثاء، لتعمق خسائرها التي سجلتها الجلسة الماضية

قراءة المزيد

GOLD ALSABAEK

15

ديسمبر

ارتفعت أسعار الذهب في أولى جلسات الأسبوع الذي يشهد صدور بيانات اقتصادية هامة عن سوق العمل في الولايات المتحدة

قراءة المزيد

GOLD ALSABAEK

13

ديسمبر

يواصل الذهب اتجاهه الصعودي لليوم الرابع على التوالي، متجاوزًا حاجز 4300 دولار، مسجلًا أعلى مستوى له منذ 21 أكتوبر خلال النصف الأول من جلسة التداول الأوروبية يوم الجمعة.

قراءة المزيد

GOLD ALSABAEK

09

ديسمبر

يرى الرئيس الأمريكي "دونالد ترامب" أن المكسيك تعامل المزارعين الأمريكيين بصورة غير عادلة، وهدد برفع الرسوم الجمركية على واردات بلاده منها.

قراءة المزيد

GOLD ALSABAEK

03

ديسمبر

يواجه الذهب صعوبة في الاستفادة من ارتفاع طفيف خلال اليوم، ويتراجع إلى أدنى مستوياته اليومية مع بداية الجلسة الأوروبية يوم الأربعاء

قراءة المزيد

GOLD ALSABAEK

02

ديسمبر

انخفضت العقود الآجلة للأسهم الأمريكية بشكل طفيف يوم الثلاثاء بعد تراجع وول ستريت في أول يوم تداول من شهر ديسمبر، عقب مكاسبها في الجلسات الخمس السابقة.

قراءة المزيد

GOLD ALSABAEK

02

ديسمبر

انخفضت أسعار الفضة بأكثر من 1% لتصل إلى 57 دولارًا للأونصة يوم الثلاثاء، حيث عمد المستثمرون إلى جني الأرباح عقب تسجيلها مستوى قياسيًا مرتفعًا.

قراءة المزيد

GOLD ALSABAEK

01

ديسمبر

ارتد اليورو فوق 1.16 دولار أمريكي، مسجلاً أقوى مستوى له منذ منتصف نوفمبر، مع توخّي المستثمرين الحذر قبيل صدور بيانات اقتصادية رئيسية من منطقة اليورو والولايات المتحدة قد تؤثر على توقعات أسعار الفائدة.

قراءة المزيد

GOLD ALSABAEK

01

ديسمبر

ارتفعت أسعار الذهب خلال تعاملات الإثنين، في ظل عزوف المستثمرين عن الأصول الخطرة والتوجه إلى الملاذ الآمن، مع تزايد احتمالات خفض أسعار الفائدة الأمريكية

قراءة المزيد

GOLD ALSABAEK

29

نوفمبر

مع استمرار الوكالات الفيدرالية الأمريكية في إدارة جداول النشر عقب إغلاق الحكومة، ينتظر المستثمرون تأخر النشرات الرسمية واستطلاعات الرأي الخاصة الجديدة

قراءة المزيد

GOLD ALSABAEK

29

نوفمبر

تجاوز سعر الذهب 4,225 دولارًا للأونصة يوم الجمعة، مسجلًا أعلى مستوى له في شهر، وهو في طريقه لتحقيق مكاسبه الشهرية الرابعة على التوالي، حيث تتوقع الأسواق ارتفاع احتمالية خفض أسعار الفائدة من قِبَل الاحتياطي الفيدرالي في ديسمبر. وقد عززت تصريحات عدد من مسؤولي الاحتياطي الفيدرالي المتشددة، بالإضافة إلى تأخر البيانات الاقتصادية التي أظهرت ضعفًا، توقعات تخفيف السياسة النقدية.

قراءة المزيد

GOLD ALSABAEK

24

نوفمبر

تراجعت أسعار العقود الآجلة للذهب مع استقرار الدولار قرب أعلى مستوياته في ستة أشهر، في حين يترقب المستثمرون مزيدًا من الوضوح بشأن مسار أسعار الفائدة في الولايات المتحدة.وخلال تداولات الإثنين، انخفضت أسعار العقود الآجلة للمعدن الأصفر تسليم ديسمبر بنسبة 0.65% أو 27 دولارًا عند 4052.50 دولار للأونصة.

قراءة المزيد

GOLD ALSABAEK

22

نوفمبر

من المرجح أن يشهد أسبوع عيد الشكر المُختصر في الولايات المتحدة استمرار الوكالات الرسمية في الإعلان عن مواعيد إصدار جديدة للبيانات المُؤجّلة بسبب إغلاق الحكومة الفيدرالية. وستتصدر أسعار المنتجين، ومبيعات التجزئة، وطلبات السلع المعمرة لشهر سبتمبر المنشورات الأمريكية المُؤكّدة.كما سيتم نشر مُجمّعات أسعار المساكن الرئيسية والمسوحات الاقتصادية الإقليمية. في غضون ذلك، سينشر وزير الخزانة البريطاني، ريفز، ميزانية الخريف التي طال انتظارها. وفي أماكن أخرى في أوروبا، من المُقرّر أن تُعلن أكبر اقتصادات منطقة اليورو عن معدلات التضخم لشهر نوفمبر والمؤشرات الرئيسية الرائدة التي تقيس ثقة الأعمال والمستهلكين.كما ستُراقب معدلات التضخم في أستراليا، والبرازيل، والمكسيك، وسنغافورة، واليابان من خلال مؤشر أسعار المستهلك في طوكيو. في غضون ذلك، ستقوم كندا والهند بتحديث ناتجهما المحلي الإجمالي، وسيُحدّد بنك الاحتياطي النيوزيلندي سعر فائدته.

قراءة المزيد

GOLD ALSABAEK

22

نوفمبر

قلص الذهب خسائره إلى حوالي 4,060 دولارًا للأونصة يوم الجمعة، لكنه ظل على مساره نحو الانخفاض الأسبوعي، حيث استوعبت الأسواق بيانات العمل الأمريكية الأقوى، وإشارات البنك المركزي التيسيرية، وتراجع عوائد السندات الأمريكية.أظهر تقرير وزارة العمل المتأخر ارتفاعًا في الوظائف غير الزراعية بمقدار 119 ألف وظيفة في سبتمبر، وارتفاع معدل البطالة إلى 4.4%، مما قلل في البداية من احتمالات خفض أسعار الفائدة على الفور من قِبَل الاحتياطي الفيدرالي، ودفع الدولار إلى الارتفاع.

قراءة المزيد

GOLD ALSABAEK

21

نوفمبر

تراجعت أسعار العقود الآجلة للذهب بعدما عزز تقرير الوظائف الأمريكي، الذي جاء أقوى من المتوقع، التوقعات بامتناع الاحتياطي الفيدرالي عن خفض أسعار الفائدة في اجتماعه لشهر ديسمبر.وخلال تداولات الجمعة، انخفضت أسعار العقود الآجلة للمعدن الأصفر تسليم ديسمبر بنسبة 0.5% أو 19.70 دولار عند 4040.30 دولار للأونصة.وتراجع سعر التسليم الفوري للذهب بنسبة 0.85% عند 4043.15 دولار للأونصة، كما هبط نظيره للفضة بأكثر من 3% عند 49.02 دولار للأونصة.فيما انخفض مؤشر الدولار -الذي يقيس أداء العملة الأمريكية أمام سلة من ست عملات رئيسية- بنسبة طفيفة بلغت 0.1% عند 100.04 نقطة.وهبطت العقود الآجلة للفضة تسليم ديسمبر بنسبة 2.75% عند 49.56 دولار للأونصة، وخسرت كل من الأسعار الفورية للبلاتين نحو 0.45% عند 1511.84 دولار، ونظيرتها للبلاديوم بنسبة 0.6% عند 1372.59 دولار.وبحسب أداة "فيد واتش"، تراجعت توقعات خفض أسعار الفائدة بمقدار 25 نقطة أساس خلال اجتماع مجلس الاحتياطي الفيدرالي في ديسمبر إلى 35.4% من 98.1% قبل شهر، في مقابل ارتفاع توقعات تثبيت السياسة النقدية إلى احتمال 64.6% من 1.7%.

قراءة المزيد

GOLD ALSABAEK

20

نوفمبر

ارتفعت أسعار النفط خلال تعاملات الخميس، مع التفاؤل بآفاق الطلب في الولايات المتحدة عقب انخفاض أكبر من المتوقع في مخزونات الخام الأمريكي الأسبوع الماضي.وصعدت العقود الآجلة لخام "برنت" تسليم يناير 2026 بنسبة 0.25% أو 16 سنتا إلى 63.67 دولار للبرميل .وزادت العقود الآجلة لخام "نايمكس" تسليم ديسمبر بنسبة 0.35% أو 22 سنتا إلى 59.66 دولار للبرميل.وتعافى كلا الخامين القياسيين قليلاً بعد انخفاضهما بأكثر من 2% في جلسة الأربعاء، عقب تقرير لـ"رويترز" أفاد بأن الولايات المتحدة أبلغت أوكرانيا بقبول إطار مقترح لإنهاء الحرب مع روسيا يتضمن التخلي عن أراضٍ وبعض الأسلحة، وفقًا لمصدرين على دراية بالمحادثات.وذكرت إدارة معلومات الطاقة الأمريكية أن مخزونات النفط الخام تراجعت بمقدار 3.4 مليون برميل في الأسبوع المنتهي في 14 نوفمبر، مقارنةً بتوقعات بانخفاض قدره 603 آلاف برميل، وحدّ من مكاسب الأسعار ارتفاع مخزونات البنزين والمقطرات لأول مرة منذ أكثر من شهر.

قراءة المزيد

GOLD ALSABAEK

20

نوفمبر

يجذب الذهب بعض البائعين بعد ارتفاعه خلال اليوم إلى مستوى 4,110 دولارات أمريكية، مبتعدًا عن أعلى مستوى أسبوعي له الذي لامسه في اليوم السابق. ولا يزال شراء الدولار الأمريكي مستمرًا وسط تراجع التوقعات بخفض آخر لأسعار الفائدة من قبل مجلس الاحتياطي الفيدرالي الأمريكي في ديسمبر، الأمر الذي يُتوقع أن يُؤثر سلبًا على المعدن الأصفر الذي لا يُدر عائدًا. إضافةً إلى ذلك، يُعدّ التفاؤل السائد في أسواق الأسهم العالمية عاملًا آخر يُضعف الطلب على السبائك الآمنة.تشير الخلفية الأساسية المذكورة آنفًا إلى أن مسار الذهب الأقل مقاومة هو الاتجاه الهبوطي. ومع ذلك، قد يختار المتداولون انتظار صدور تقرير الوظائف غير الزراعية الأمريكية لشهر سبتمبر قبل وضع توقعات جديدة حول اتجاه زوج الذهب. علاوة على ذلك، قد تُحدّ المخاوف بشأن ضعف الزخم الاقتصادي على خلفية أطول إغلاق حكومي أمريكي على الإطلاق من خسائر أعمق للمعدن النفيس.

قراءة المزيد

GOLD ALSABAEK

20

نوفمبر

ارتفع الذهب قليلاً يوم الأربعاء، حيث عززت حالة العزوف عن المخاطرة في الأسواق العالمية الطلب على الملاذ الآمن. في وقت كتابة هذا التقرير، يُتداول الذهب حول 4,113 دولارًا أمريكيًا، بارتفاع يقارب 1%، مواصلًا انتعاشه بعد انخفاضه لفترة وجيزة دون عتبة 4,000 دولار أمريكي يوم الثلاثاء.لا تزال الأسهم العالمية تحت الضغط وسط قلق بشأن تقييمات شركات التكنولوجيا المبالغ فيها، مما يُبقي المستثمرين في موقف دفاعي في انتظار إعلان أرباح شركة إنفيديا. كما أن المعنويات حذرة قبيل صدور محضر اجتماع اللجنة الفيدرالية للسوق المفتوحة في وقت لاحق من اليوم، حيث تستعد الأسواق لتقرير الوظائف غير الزراعية المتأخر لشهر سبتمبر، والمقرر صدوره يوم الخميس. في المقابل، يُساعد جو العزوف عن المخاطرة المعدن الأصفر على الحفاظ على زخمه الصعودي.مع ذلك، فإن تزايد الشكوك بين مسؤولي الاحتياطي الفيدرالي بشأن خفض أسعار الفائدة مرة أخرى في ديسمبر يُلقي بظلاله على توقعات السياسة النقدية.

قراءة المزيد